To get a report on all purchases made where sales tax was not charged, create a Transaction Detail by Date report and filter it for Transaction type: Check, Bill Account: Sales Tax Payable, and the date range that you want This report will show all transactions on which you recorded a use taxable purchase.

Sales tax in footer quickbooks for mac plus#

When you pay the tax to the state, select all of the sales tax items plus the last line with no sales tax item and it will add the extra tax to your payment. This will increase Sales Tax Payable and it will show up in the Pay Sales Tax window on a line with no sales tax item (the one where you normally see sales tax adjustments).

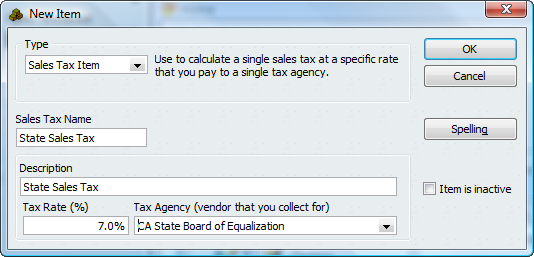

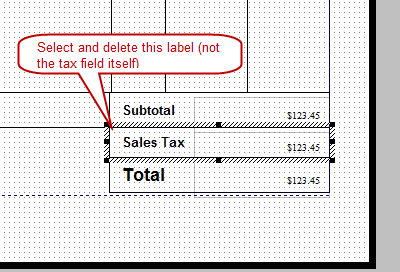

In the “name” column of the Sales Tax Payable line, enter your sales tax agency. When you make a purchase for $100 in taxable office supplies (but tax is not charged), record the purchase by assigning $105 to the expense account (office supplies) and -$5 to Sales Tax Payable. Let’s say that you purchased $100 in office supplies for your own use but you didn’t pay sales tax at the time of the purchase. Those are taxable purchases, but you might not pay the sales tax at time of purchase because you have a tax-exempt certificate filed with the supplier, or you purchased it from an out-of-state vendor who does not collect sales tax for your state. This situation occurs when your company purchases items for use in your own business and not for resale. If you don’t pay any tax when you purchase, but you need to pay a “Use Tax” on your sales tax return, you’ll need to track these purchases so you can get a report on all such purchases later. Therefore, I need to add the Use Tax to my sales tax payments (and sales tax return), but I don’t know how I can track these purchases. How can I track Use Tax on purchases I make? Occasionally I purchase items from a vendor that does not charge tax (I have a resale certificate filed with the vendor), but the goods are taxable because I hold them for my own use. However, they are required to report those purchases to the state in which they“use” the purchased items, and then remit the tax that should have been charged by the seller on the original sale date. To the left of that is a drop-down list containing the correct Sales Tax Item or Sales Tax Group. set up a repair, or make a Genius Bar appointment for iPhone, iPad, Mac and more. Look to the left of those numbers, and you’ll see the actual rate that was applied. We are using the widget Insert Header Footers to add the chat tool. In states that charge sales tax, purchasers within those states often avoid paying tax by purchasing items from out-of-state suppliers. QuickBooks will have calculated the sales tax due using the Sales Tax Item or Group you assigned to that customer during setup, placing it in the Tax field.

Sales tax in footer quickbooks for mac how to#

I was recently asked by a reader about how to track Use Tax on purchases in QuickBooks.

0 kommentar(er)

0 kommentar(er)